BUSINESS

Multi-Talented Entrepreneur and the Founder of GOQii, Vishal Gondal

Vishal Gondal is the Founder and CEO of GOQii, which is a one-of-a-kind combination of health coaching and a smart fitness tracker driven by an integrated mobile app.

In 2011, Gondal sold Indiagames, a game development and publishing firm he created, to Disney UTV Digital, a part of The Walt Disney Company India. He was the Digital Division Managing Director for The Walt Disney Company in India.

On September 4, 2020, Bollywood celebrity Akshay Kumar revealed that FAU-G, a game developed by Bengaluru-based nCORE Games and published by Vishal Gondal, would be released on January 26, 2021. Gondal founded Sweat and Blood Venture Group in 2008 to invest in early-stage entrepreneurs.

He founded GOQii in 2014 with the goal of encouraging customers all around the world to live healthier and better lives. The preventative healthcare ecosystem is brought together by GOQii’s smart tech-enabled healthcare platform. Its Smart Health Ecosystem combines tools for real-time personalised coaching, an explosive high-growth Health e-commerce store, scheduling health check-ups, a health locker, a unique ‘GOQii Cash’ programme that rewards healthy behaviour with cash and insurance discounts based on health management data, and live coaching by experts on GOQii Play, the health OTT platform.

Given the current status of India’s ‘Sickcare’ delivery infrastructure, the organisation is certain that preventative healthcare is the only long-term, mass-market option. Mitsui, NEA, Megadelta, DSG Consumer Partners, Galaxy Digital, Denlow Investment Trust, Edelweiss, Cheetah Mobile, GWC, Mr Ratan Tata, and Mr Vijay Shekhar Sharma are among GOQii’s notable investors. The company is based in Menlo Park, California, and has operations in Mumbai, India.

Entrepreneurs

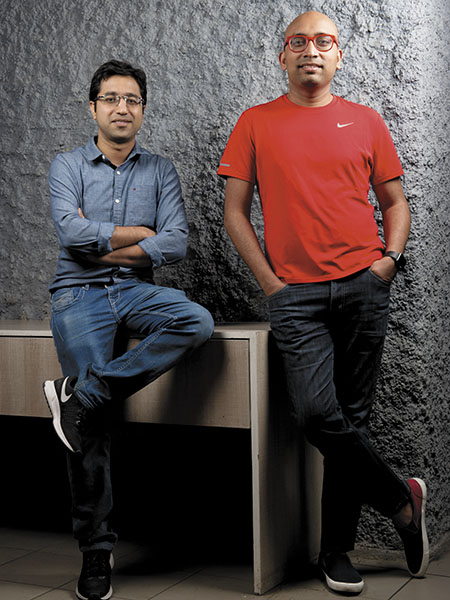

The WittyFeed Triumph: Vinay Singhal, Parveen Singhal, and Shashank Vaishnav’s Journey to Content Dominance

Vinay Singhal, Parveen Singhal, and Shashank Vaishnav have created a stunning success story with WittyFeed in the digital world, where content is king. Rising from the ashes of failed businesses, these computer experts changed course and built the second-largest content platform globally, only surpassed by BuzzFeed. This piece explores the story of these visionary founders and how WittyFeed rose to prominence in the content industry.

In 2013, faced with the setbacks of two unsuccessful ventures, Vinay, Parveen, and Shashank decided to stay the course. Ditching Evrystry.com and FollowMe247, they envisioned a content platform that catered to the needs of content creators, distributors, and consumers. This vision materialized in September 2014 with the launch of WittyFeed—a platform that rapidly ascended the ranks to become the third-most visited website in the Indian entertainment category.

For Vinay Singhal, WittyFeed is not just a content platform; it’s a technology play. Leveraging robust technology and analytics, WittyFeed ensures its content goes viral by intricately guiding content selection, creation, distribution, and monetization. Real-time data analysis and insights into user behavior empower thousands of influencers to disseminate content, making WittyFeed a formidable player in the global content arena.

WittyFeed’s strategic foresight extends to its strong network of influencers, positioning the platform years ahead of its competitors. Recognizing influencers as the distributors in the digital world, WittyFeed created Viral9.com—an influencer platform with around 15,000 influencers. These influencers, with millions of followers, redirect traffic to WittyFeed, creating a symbiotic relationship that propels the platform’s reach.

WittyFeed’s impact transcends borders, with a presence in Spain, the US, and the UK, while rapidly gaining traction in India. The platform boasts over 100 million sessions and 60 million unique visitors monthly, generating revenues of ₹30 crore in FY17. Programmatic advertising forms a significant revenue stream, complemented by sponsored content collaborations with around 70 brands, including Uber, Coca-Cola, and Zee Studios. By endearing itself to brands, WittyFeed aims to derive 40 percent of its revenues from brand partnerships.

While WittyFeed has thrived, the platform remains vigilant about potential challenges, especially as Facebook’s algorithms evolve. Vinay emphasizes the importance of steering clear of click-bait and focusing on quality content to maintain a symbiotic relationship with Facebook. Future strategies include the integration of video content, fostering collaborations with mobile apps, and seeking a series A funding round for expansion.

The success of WittyFeed lies in the synergy of its founders—Parveen Singhal, Vinay Singhal, and Shashank Vaishnav. Parveen, the Chief Content Officer, envisions video content as the next growth frontier. Vinay, with a knack for building solutions, steers the technology-driven aspects, while Shashank, the Chief Technology Officer, brings real-time data analytics to the forefront.

As WittyFeed charts a course toward greater heights, its founders remain attuned to the evolving nature of digital consumption. Vinay Singhal encapsulates the essence of their journey, emphasizing the imperative of staying at the forefront of change. The triumvirate’s journey from the brink of failure to commanding one of the world’s largest content platforms is not just a success story; it’s a testament to resilience, innovation, and the power of strategic vision. In an ever-evolving digital landscape, WittyFeed and its founders stand poised for continued impact and influence.

Entrepreneurs

Rahul Narang and Saurabh Arora: Architects of Healthcare Transformation at Lybrate

Rahul Narang and Saurabh Arora‘s combined genius is evident in the rapidly changing field of healthcare innovation as they lead Lybrate, a ground-breaking online platform for medical consultations. The story takes place against the backdrop of Saurabh Arora, who attended Columbia Business School and IIT Delhi before purposefully changing his course. 2014 saw Arora leave his position as a data scientist at Facebook in Silicon Valley in order to pursue his homegrown business goals. This crucial choice launched Lybrate in 2015, a platform that has the potential to completely transform patient-doctor relations.

Arora’s vision for Lybrate germinated during a visit to India, where he keenly observed the challenges posed by self-medication in rural areas and the inconveniences faced by urban denizens. Fueled by a determination to bridge these gaps, Arora enlisted the expertise of his former colleague and friend, Rahul Narang, who assumed the role of co-founder and chief technology officer at Lybrate.

The platform, operating as an online out-patient department (OPD), strategically deploys technology to enhance the accessibility of quality healthcare across India. Arora’s mission was to seamlessly connect patients and doctors, transcending geographical constraints. In less than three years, Lybrate has garnered over 1 lakh registered doctors, facilitating upwards of 6 million interactions monthly. These interactions span doctor searches, health queries, and appointments for consultations and lab tests.

The triumph of Lybrate can be attributed to its innovative approach and meticulous planning. Arora underscores the critical importance of aligning the product with the workflow of doctors, fostering positive word-of-mouth recommendations. The nascent stages involved securing funding, with Gokul Rajaram, a luminary in developing Google’s AdSense network, playing a pivotal role. Lybrate secured a seed round of $1.23 million from Nexus Venture Partners, Rajaram, and independent investor Vispi Daver in August 2014. A subsequent funding round in July 2015 saw a commitment of $10.2 million from Tiger Global, Nexus Venture Partners, and Ratan Tata, propelling Lybrate’s mission to new heights.

The healthcare landscape in India presents a formidable challenge, marked by a concerning doctor-patient ratio of 1:1,700, as highlighted by a joint report from KPMG and Ficci. What sets Lybrate apart is its unwavering focus on alleviating the doctor shortage. The platform’s workflow begins with anonymous health-related queries from patients, evolving into online or offline consultations as comfort levels with the doctors on the platform grow.

Lybrate’s distinctive patient engagement model places the patient at the center, offering access to a comprehensive spectrum of healthcare services. This strategic differentiator positions Lybrate favorably against Practo, its major competitor, which primarily functions as a doctor discovery platform. While Practo concentrates on appointment scheduling, Lybrate is committed to transforming the patient-doctor interaction and propelling it into the digital realm.

Despite the myriad challenges, Lybrate has achieved a commendable turnover of over ₹22.45 crore in FY15-16, with aspirations to reach ₹25 crore in the current fiscal year. The platform boasts various revenue streams, including ‘Lybrate Consult,’ allowing users to consult preferred doctors for a fee. ‘Lybrate Lab+’ and ‘Lybrate Cube’ contribute significantly to the company’s revenue by facilitating lab tests and providing tools for doctors to enhance their online presence.

As the health tech industry witnesses an influx of competitors, Lybrate’s early entry into the fray positions it as a frontrunner. However, challenges persist, and success in this dynamic landscape hinges on delivering a substantial value proposition for both patients and doctors. The journey of Rahul Narang and Saurabh Arora with Lybrate symbolizes a commitment to quality and innovation, marking the advent of a new era in online healthcare solutions.

Entrepreneurs

Abhishek Shah: Revolutionizing Diabetes Care Through Digital Therapeutics

Abhishek Shah, the 34-year-old CEO of Mumbai-based Wellthy Therapeutics, stands out as an innovator in a world where chronic illnesses like type 2 diabetes are becoming more prevalent. With its AI-powered smartphone app that provides a customised health coach experience, Wellthy Therapeutics aims to revolutionise the treatment of type 2 diabetes. The journey of Abhishek Shah, the founding of Wellthy, and the significant influence it has had on patients such as Smruti Daru are all covered in this article.

Abhishek Shah’s foray into healthcare entrepreneurship was inspired by personal experiences. Growing up in a family of healthcare entrepreneurs, with parents diagnosed with chronic diseases, Shah witnessed the challenges of managing conditions like hypertension and diabetes. This exposure laid the foundation for Wellthy Therapeutics, founded in 2015 with the vision of leveraging technology for behavioral change in healthcare.

Wellthy Therapeutics’ mobile app serves as a personal health coach, utilizing AI to analyze patient data and habits. The app provides continuous guidance and motivation for adopting healthier lifestyle choices, crucial for managing type 2 diabetes. For individuals like Smruti Daru, the app has been transformative, helping her achieve significant improvements in glycated haemoglobin levels and weight within a short period.

At the core of Wellthy’s philosophy is an outcome-focused approach. Abhishek Shah emphasizes the importance of improving patient outcomes by addressing behavioral changes. The app guides patients through their daily routines, encouraging them to log diet, monitor sugar levels, track weight, and adhere to exercise routines. This focus on quantifiable outcomes sets Wellthy apart in the realm of digital therapeutics.

Wellthy Therapeutics has garnered recognition and endorsements from major organizations. Partnering with the Research Society for the Study of Diabetes in India (RSSDI) in 2016, Wellthy became a prescribed application for doctors. The company presented positive clinical outcomes at an American Diabetes Association conference, establishing itself as the first South Asian digital therapeutics firm with such achievements. Understanding the unique cultural nuances of India and Asia, Wellthy tailored its app to cater specifically to the genetic makeup, behavior, and values prevalent in the region. Recognizing that two-thirds of the world’s diabetics reside in Asia, Wellthy’s regional focus positions it strategically in the fight against diabetes.

Abhishek Shah’s commitment to improving healthcare outcomes is reflected in Wellthy’s self-funded growth. Investing around ₹2.9 crore into the venture, Shah prioritized creating a product that genuinely benefited patients. Wellthy’s expansion involves unique partnerships with hospitals, doctors, patients, and insurance companies, laying the groundwork for future growth. With plans to go live in the Middle East later this year, Wellthy envisions achieving a full-fledged presence in Asia within four to five years. The company’s trajectory aligns with its mission to redefine diabetes care through innovative technology and a patient-centric approach.

For Abhishek Shah, the journey of building Wellthy intertwines with the personal milestone of becoming a father. This balancing act, navigating the realms of first-generation entrepreneurship and first-time fatherhood, shattered perceived limitations and unlocked newfound capabilities. Shah’s dedication to his vision has not only transformed his life but has become a source of empowerment for individuals managing diabetes.

-

ENTERTAINMENT4 years ago

ENTERTAINMENT4 years agoBaahubali: The Beginning completes five years, Tamannaah Bhatia shares video

-

ARTIST3 years ago

ARTIST3 years agoIndia’s famous Rock Kirtan Band, Madhavas Rock Band

-

LATEST UPDATES4 years ago

LATEST UPDATES4 years agoTwist in serial Anupama will come soon, these three stars will be entered in the show

-

ENTERTAINMENT4 years ago

ENTERTAINMENT4 years agoTrouble of 58 year old Sunil Shetty, I am not young, I am not old

-

ENTERTAINMENT4 years ago

ENTERTAINMENT4 years agoMeet Purav Jha The Viral Sensation

-

LATEST UPDATES4 years ago

LATEST UPDATES4 years agoCBSE 12th Topper List Jharkhand: State Topper of Ranchi, Adyasha Top in Bokaro, see Toppers List here

-

ENTERTAINMENT4 years ago

ENTERTAINMENT4 years agoPiya Albela fame Sheen-Akshay coming again, will be seen in this serial

-

ARTIST3 years ago

ARTIST3 years agoFemale Entrepreneur & Adult Film Star Sky Black Shares Her Story of Success!