BUSINESS

Jio gets 6th significant interest in lockdown, Abu Dhabi’s organization will bargain

The procedure of speculation of remote financial specialists is proceeding on Reliance Industries’ Jio stage. The organization has gotten the 6th significant interest in the lockdown.

• Abu Dhabi’s organization to purchase 1.85% stake in Jio

• Jio said that this arrangement is worth 9,093.60 crores

Lockdown has been actualized in various stages since March 25. In this lockdown,

Dependence Industries’ telecom organization Jio has got 6 significant remote speculations in a steady progression. This time the organization of Reliance Jio has put resources into Abu Dhabi. As indicated by the data, the Abu Dhabi-based organization Mubadala will purchase a 1.85 percent stake in Reliance Jio. This arrangement is worth 9,093.60 crores.

What did the organization state?

Reliance Jio said in an explanation that Mubadala Investment Company (Mubadala) will put Rs 9,093.60 crore in the Jio stage. For this, the valued esteem is 4.91 lakh crore rupees and the undertaking esteem is 5.16 lakh crore rupees. Simultaneously, Reliance Industries Chairman Mukesh Ambani said in an announcement, ‘Through my long-lasting relationship with Abu Dhabi, I have by and by observing the effect of Mubadala’s work. We trust that the organization will profit from Mubadala’s understanding. ‘

Managing Director of Mubadala Investment Company Khaladun Al Mubarak said that Jio has just changed correspondence and availability in India. As a financial specialist and accomplice, we are focused on supporting India’s advanced improvement venture.

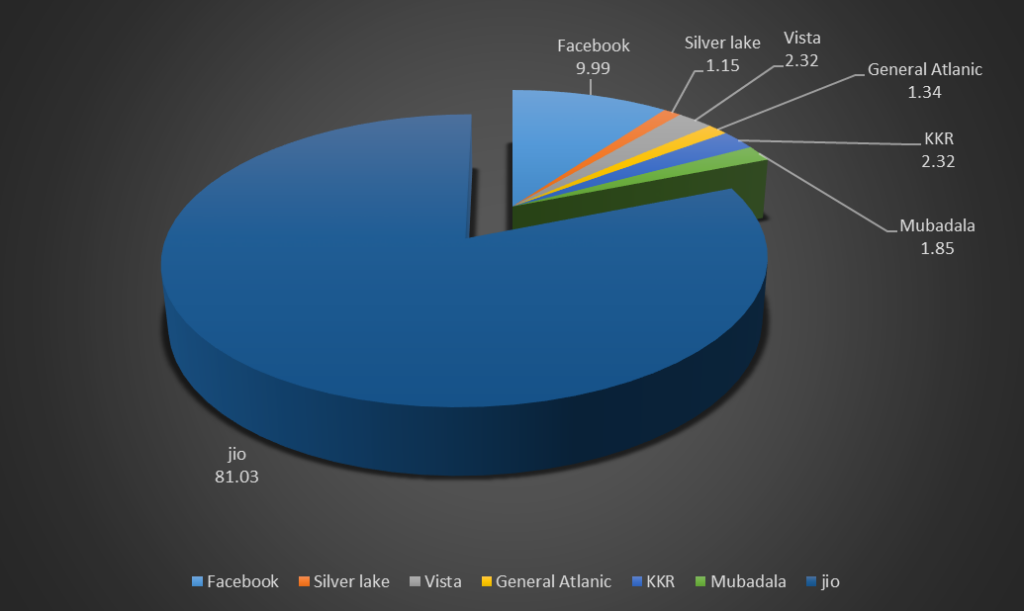

Jio sold around 19% of its stake

Let you realize this is the 6th arrangement by Reliance over the most recent couple of weeks, through which a sum of Rs 87,655.35 crore has been raised up until now. Preceding Mubadala, Facebook, Silver Lake, Vista Equity Partners, General Atlantic, and KKR have reported speculations on stages. Thusly, Jio has sold around 19 percent of its stake. The measure of speculation made by these organizations or financial specialists will help Reliance Industries to become obligation-free.