Entrepreneurs

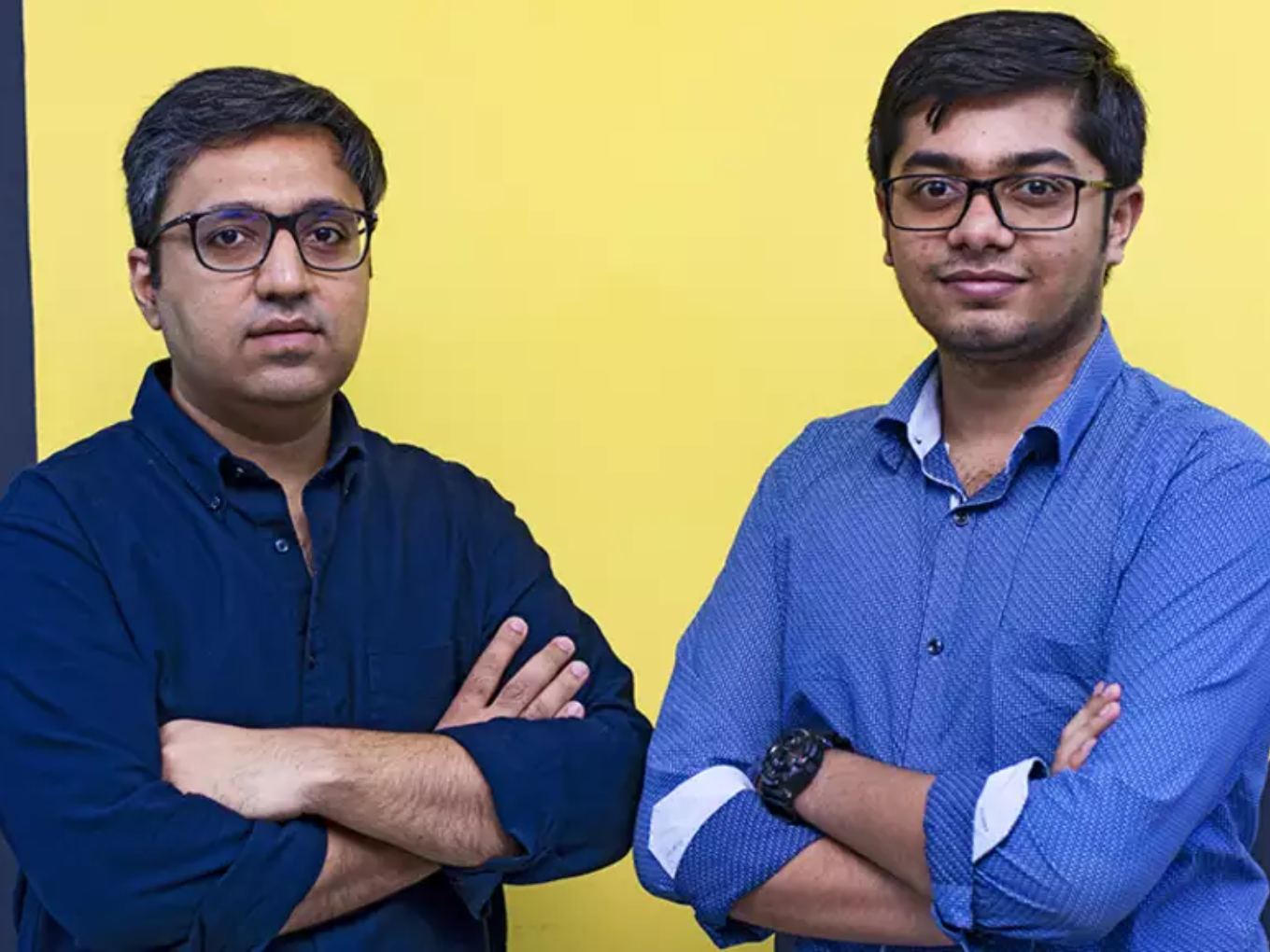

Shashvat Nakrani and Suhail Sameer Driving Innovation and Growth at BharatPe

The Indian retail grocery sector is teeming with competitors, boasting a staggering 13 million retailers. However, not too long ago, many of these small businesses grappled with financial challenges, particularly when it came to accessing upfront cash, embracing digital payments via UPI or cards, obtaining quick loans for expansion, or securing working capital for restocking inventory. In response to these daily struggles faced by retailers, Ashneer Grover and Shashvat Nakrani co-founded BharatPe in March 2018. Since its inception, BharatPe has made remarkable strides in alleviating these challenges, empowering over 10 million merchants across 400+ cities. The platform processes an impressive $20 billion in annualized Total Payment Volume (TPV) for payments.

BharatPe’s core philosophy centers around introducing unique and market-disruptive products. Notably, the company launched a single QR code solution that enables small businesses to accept various forms of digital payments cost-effectively. This innovation played a pivotal role in reshaping the landscape of UPI payments in India. In 2020, BharatPe introduced India’s first interoperable zero MDR QR code, providing even greater convenience for merchants. The company expanded its offerings to include a lending product, which leverages UPI payments to offer merchant cash advances—an Electronic Data Exchange (EDI) solution, a pioneering concept in India. Additionally, BharatPe ventured into the investment sector, offering products with impressive returns of 10-12%. According to Shashvat Nakrani, BharatPe’s co-founder, their approach to product development hinges on launching solutions that either disrupt the market with a unique proposition or not launching them at all. Their commitment to innovation is unwavering, even if it means discontinuing products that do not perform well.

Balancing Innovation and Processes:

Suhail Sameer, BharatPe’s CEO, emphasizes that innovation and speed to market are deeply embedded in the company’s DNA. However, he underscores the importance of cost-effectiveness in the decision-making process. While processes are essential, they should not hinder the company’s ability to innovate rapidly. Suhail acknowledges the delicate balance between processes and execution speed. Striking this balance is crucial to ensuring continued growth without sacrificing efficiency. For BharatPe, processes are tools to accelerate progress and systematically deliver value. With a valuation of $3 billion and 10 million merchants on its platform, BharatPe has ambitious plans for the future. The company aims to further support its merchant base by expanding its lending capabilities beyond the current limit of five lakhs.

Another critical challenge faced by retailers is customer acquisition, particularly in competition with ecommerce giants that inundate consumers with advertisements. BharatPe intends to assist merchants in overcoming this hurdle. Regarding the possibility of an IPO, Suhail Sameer asserts that BharatPe will go public when it is truly IPO-ready. He emphasizes that the core business must be profitable, underlining the importance of building a sustainable business that can weather market fluctuations. While good markets may reward robust growth, Suhail believes that sustainability is the key to long-term success. Proving the ability to generate profits is essential, as it demonstrates the company’s financial resilience and sustainability. This, in turn, builds confidence among investors, including retail investors, who recognize the enduring value of the business.

In conclusion, Shashvat Nakrani and Suhail Sameer, alongside their team at BharatPe, have been driving innovation, empowering retailers, and charting a path to financial sustainability. Their relentless commitment to solving merchant pain points and fostering growth is reshaping the landscape of digital payments and financial services in India.