BUSINESS

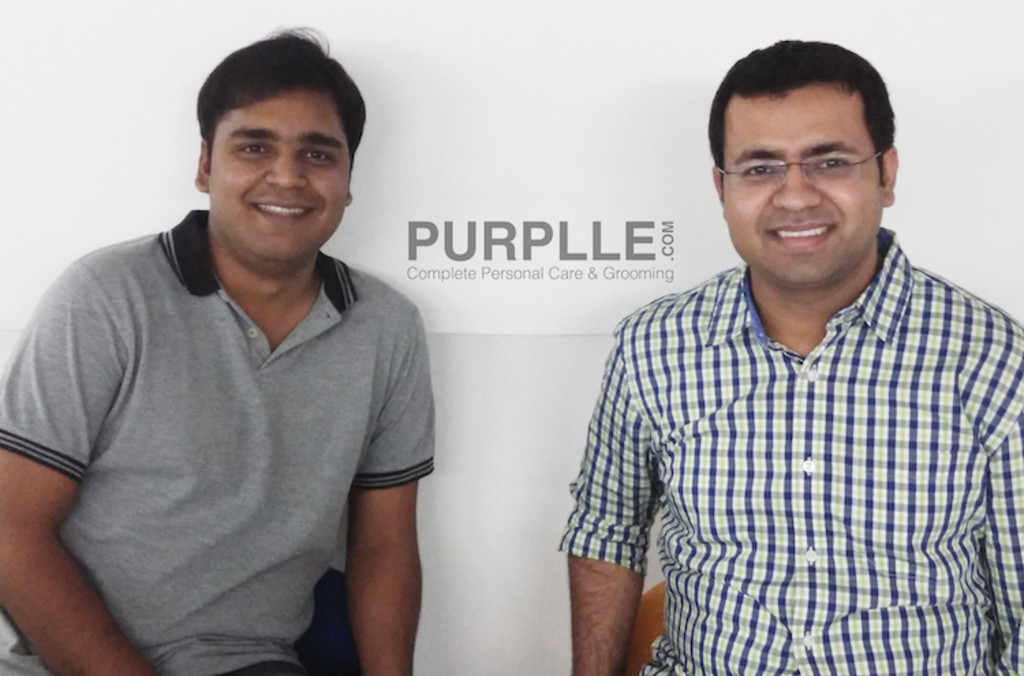

Manish Taneja and Rahul Dash: Pioneers Transforming Beauty for Women in Tier 2 Cities

In the world of beauty e-commerce, where female-oriented brands are usually helmed by women, it was an unusual sight to see three male engineers from IIT (Indian Institutes of Technology) launching a beauty brand aimed solely at women. Manish Taneja and Rahul Dash, along with their Chief Technology Officer, Suyash Katyayani, embarked on a journey to create something exceptional in a market predominantly led by women. This blog explores the ground-breaking work of Manish Taneja and Rahul Dash and how they are reshaping beauty standards and accessibility in tier 2 cities and beyond. In late 2011, Manish Taneja and Rahul Dash started their entrepreneurial journey with Purplle, relying solely on their personal savings of ₹50 lakh as capital. At the time, it was considered a primitive era for e-commerce, particularly in the beauty sector. Large FMCG (Fast Moving Consumer Goods) companies remained sceptical about the prospects of e-commerce in the beauty industry. However, Taneja and Dash recognized the potential for disruption in the sector.

Several factors fuelled their vision:

Diverse and Long-Tail Category: Beauty is a diverse and long-tail category with a vast range of products. It offered ample room for innovation and personalization.

- Digital Penetration: The growing usage of the internet and smartphones enabled greater access to beauty products and information.

- High Gross Margins: The beauty category boasts high gross margins, ranging from 60 to 70 percent, making it a lucrative space for entrepreneurs.

What sets Purplle apart is its remarkable capital efficiency. For the first eight years of its existence, the company survived and thrived with just $10 million in capital. This is a rarity in today’s start-up landscape, particularly in the e-commerce sector. Their ability to create substantial value with minimal capital investment has been a testament to their innovative approach. Purplle began its journey in approximately 1,800 pin codes and has since grown exponentially. It now offers over 1,000 brands and more than 25,000 unique products in 18,000 pin codes across India. The company not only aggregates third-party products but also has its own private brands such as Good Vibes in skincare, NYBae in makeup, and Carmesi in feminine hygiene. In December 2021, Purplle acquired cosmetics and skincare brand Faces Canada. Private brands contribute significantly to annual revenue, demonstrating Purplle’s commitment to innovation.

One of Purplle’s defining missions has been its focus on serving women in smaller towns and cities. This segment, historically underserved and neglected, presented an immense but untapped market. As digital penetration in India continued to rise, Purplle was ideally positioned to make beauty products accessible to a broader and more diverse audience. This approach has paid off as the Economic Survey of India 2021-22 reports that India surpassed 800 million internet subscribers in 2020-21. Purplle’s rapid success has resulted in the company raising approximately ₹1,366 crore ($180 million) in capital. In December 2021, the company conducted an extended Series D funding round, securing ₹416 crore (close to $55 million) at a valuation of over ₹5,400 crore ($725 million). Their impressive cap table includes esteemed investment firms such as Sequoia, Goldman Sachs, Blume Ventures, Verlinvest, Kedaara Capital, and Premji Invest.

Like many start-ups, Purplle has experienced increased revenue and losses over the past year. While the company reported a loss of around ₹52 crore in FY21, Manish Taneja believes the losses have peaked and will begin decreasing in the coming year. He attributes the losses to investments in fixed assets and personnel as Purplle continues to build a high-quality management team. Purplle’s strategic advantage lies in its utilization of data. Through its proprietary beauty intelligence suite, the company analyses vast amounts of data points to understand demand and supply-side gaps and launch relevant products. Using artificial intelligence and machine learning, they’ve trained their computers to comprehend hundreds of thousands of keywords related to brands, ingredients, skin types, benefits, categories, and special attributes.